Economic bases of innovative activity in public health services

Table of contents

Introduction

1. Theoretical bases of the economic and legal substantiation of realization of innovative activity

1.1 Economic bases of innovative activity

1.2 Legal bases of innovative activity

1.3 Working out and the analysis of the innovative project

2. The technique of the estimation of efficiency of the innovative project

2.1 Existing technique of an estimation of the investment project

2.2 Offered model of an estimation of efficiency of the innovative project

2.3 Comparison of standard and offered models of an estimation of efficiency of the innovative project

3. The estimation of efficiency of the innovative project in public health services

3.1 Estimation of efficiency of the innovative project by a standard technique

3.2 Estimation of efficiency of the innovative project by an offered technique

3.3 Comparison of estimations of efficiency of the innovative project on standard and offered models

4. Management of the personnel of the scientific organizations

4.1 Personnel of the scientific organisations

4.2 Motivation of the personnel in the scientific organisations

4.3 Problem of a choice of the optimum schedule (mode) of work in the scientific organisations

5. Bases of safety of ability to live

5.1 Legal bases of a labour safety

5.2 Planning of actions for a labour safety

The conclusion

The literature list

Introduction

In modern conditions successful activity of medical institutions is in many respects defined by activity of economic service since the changes which have occurred in all spheres of our society, could not lay aside public health services. In the conditions of transition to the market without strengthening of an economic orientation of activity of the head it is difficult to count on stable work of establishment. So, is precipitate to sign contracts, to enter new medical services and to make other important decisions without corresponding economic examination. In this connection for medical institutions there is actual a question of the analysis and economic activities planning. Many of methods of economic (especially financial) analysis are not new in itself, but those are only in relation to public health services. Application (adaptation) of these methods to features of concrete area? A problem difficult enough, demanding the big work and qualification (12).

In the present degree work the innovative project of manufacture of iatrotechnics on the basis of treatment-and-prophylactic establishment will be considered. Offered in the given degree work to consideration the innovative project is developed for a substantiation of manufacture and realisation of the new medical device? The biotest?, intended for diagnostics and treatment of many of disease on a method to the developed R.Follem. This direction in medical branch has started to develop only in the last some years, and its further expansion is planned. Development of this direction has the big prospects in view of that R.Follja's method allows to treat many diseases, including congenital, and medical institutions engaged in diagnostics and treatment on R.Follja's method which will be the basic buyers of the device? The biotest?, can organise the activity in such a manner that technology use would make notable profit.

Medical institutions, private clinics and simply separate doctors constantly expand a field of the activity, all new and new services render, and aspire to receive from them benefit. Device "Biotest" allows to organise the whole medical office on research and treatment, helps with many branches of medicine. For example R.Follja's method is applied in stomatology to diagnostics of compatibility of the material, seals offered the patient and crowns, with its organism. The purpose of degree work is the substantiation of expediency of introduction of the innovative project on manufacture of the new device? The biotest?.

For achievement of this purpose in work following problems are solved:

1) to Describe the theoretical? Economic and legal? Bases of innovative activity.

2) to develop own model of an estimation of efficiency of the innovative project.

3) to spend the comparative description of standard and offered model of an estimation of efficiency of the innovative project.

4) For the considered innovative project? Device manufactures? The biotest?? To spend an efficiency estimation by both techniques, standard and developed in the present degree work.

5) to consider the important questions concerning innovative activity, such as questions of management of the personnel in the scientific organisations and ability to live safety issues at realisation of innovative activity. In the appendix to the present degree work the Passport of the innovative project is resulted.

1. Theoretical bases of the economic and legal substantiation of realization of innovative activity

1.1 Economic bases of innovative activity

Before to speak about the economic bases of innovative activity, we will short describe the basic terms and the concepts connected with innovative activity (in the field of public health services) (26). According to a management of Fraskati (the document is accepted in 1993 in the Italian city of Fraskati) the innovation is defined as the end result of the innovative activity which has received an embodiment in the form of a new or advanced product (service), introduced on the market, new or advanced technological process, or in the new approach to social services. In other words the innovation (innovation) means result of the creative activity directed on working out, creation and distribution of new kinds of products, technologies, introductions of new organizational forms etc. (31). In this connection it is necessary to consider the term an innovation as registration of result fundamental, applied or experimental researches in any field of activity, promoting development and increase of efficiency of this activity (47). Besides opinions of authors of various editions, in terminology questions it is necessary to consider standard documents. So in the project of the Federal law? About innovative activity and the state innovative policy? Following definitions of concepts considered in the present degree work (62) are given:? An innovation - the end result of the creative activity which has received realisation in the form of new either advanced production, or the new or advanced technological process used in an economic turn;? Innovative activity? Creation of the new or advanced production, the new or advanced technological process, realised in an economic turn with use of scientific researches, workings out, developmental works, or other scientific and technical achievements;? The state innovative policy? The component of a social and economic policy directed on development and stimulation of innovative activity;? Venture innovative funds? The noncommercial organisations established legal and (or) physical persons on the basis of voluntary property payments and (or) voluntary investment in exchange for a share in the share capital, the creations focused on financing, development in manufacture of new kinds of production and (or) the technologies connected with a high risk;? An infrastructure of innovative activity? The organisations rendering subjects of innovative activity of service, necessary for realisation of innovative activity. In connection with the above-stated the central concept for the present degree research? The innovative project? It is necessary to define as follows. As the innovative project we will understand the introduction business plan (manufactures and sales) innovative working out (the new goods, service or technology). The business plan, in turn, is both a substantiation of economic feasibility of introduction of an innovation, and planning of actions for realisation of the project (46). Following kinds of activity concern innovative activity (63): performance of the research, developmental and technological works directed on creation of new or advanced production, the new or advanced technological process, realised in an economic turn; Carrying out of marketing researches and the organisation of commodity markets of innovative products; creation and development of an innovative infrastructure; preparation and retraining of personnel for innovative activity; protection, transfer and acquisition of the rights to objects of intellectual property both the confidential scientific and technological information; realisation of technological re-equipment and manufacture preparation; realisation of tests, certifications and standardization of new processes, products and products; the initial period of manufacture of new or advanced production, application of new or advanced technology before achievement of a standard time of recovery of outlay of the innovative project; financing of innovative activity, including realisation of investments into innovative programs and projects; other kinds of works which necessary for realisation of innovative activity and are not contradicting the legislation of the Russian Federation. Further from the conceptual device we will pass to the description of the economic bases of innovative activity. Above it was already told about necessity of steadfast consideration of the questions connected with an economic aspect of activity of treatment-and-prophylactic establishments. The first, what it is necessary to note in this connection? This increase of the importance of economic service in activity of the medical institutions, connected with increase of the importance of financial indicators. Other moment? This essential change last years character of economic work, increase of its complexity and labour input? Complexity and labour input of economic work in public health services is connected, first of all, with expansion of sources of financing, various principles of planning (40). The Major factors influencing occurrence of new directions in economic work of medical institutions, Changes in public health services economic mechanism are following (53: 1)). 2) the Computerization of establishments of public health services. 3) changes of the status and the organizational-legal form of medical institutions, their transformation into full managing subjects with the wide rights in questions of the organisation of the work. One of the major kinds of economic work traditionally is planning. In modern conditions its relative density. However in modern conditions instead of charges of medical institutions priority value starts to get costs planning on the medical aid rendering, called to provide coordination of resources with volumes of the rendered services, instead of quantity of capacities (the areas, cots, states etc.) (20). By consideration of new tendencies in approaches to the analysis of economic activities of medical institutions what varies not only toolkit of the economic analysis, but also a methodological basis is essentially important? The economic analysis of work of medical institution acts as the analysis of activity of the independent and full managing subject, instead of simply consumer of resources as it was earlier (39). Rather new sphere of activity of economic service is pricing. This problem has got the practical importance in connection with introduction of a new economic mechanism and obligatory medical insurance (35). In the conditions of market relations at an establishment of the sizes of a payment it is necessary to consider a supply and demand both on a labour market, and in the market of medical services (48).

1.2 Legal bases of innovative activity

Innovative activity is carried out according to the Constitution of the Russian Federation and the Civil code of the Russian Federation. The Project of the Federal law on innovations and innovative activity Besides, prepares. To regulate innovative activity according to this Law and laws accepted according to it and other standard legal certificates of the Russian Federation, laws and other standard legal certificates of subjects of the Russian Federation, and also the international contracts of the Russian Federation, concerning innovative activity (64). If the Federal Law on innovative activity while exists only in the project in many regions of Russia Regional laws on innovative activity (63) operate. Regional laws on innovations and innovative activity and the Project of the Federal law are under construction approximately on the same structure, therefore for illumination of legal bases of innovative activity it will be pertinent to state the maintenance and substantive provisions of the Project of the Federal law on innovations and innovative activity, having resulted the maintenance of this Project (62). We will consider substantive provisions of this Project. First of all, in the Project it is supposed to consider following concepts: an innovation? The end result of the creative activity which has received realisation in the form of new either advanced production, or the new or advanced technological process used in an economic turn; innovative activity? Creation of the new or advanced production, the new or advanced technological process, realised in an economic turn with use of scientific researches, workings out, developmental works, or other scientific and technical achievements; the state innovative policy? The component of a social and economic policy directed on development and stimulation of innovative activity; venture innovative funds? The noncommercial organisations established legal and (or) physical persons on the basis of voluntary property payments and (or) voluntary investment in exchange for a share in the share capital, the creations focused on financing, development in manufacture of new kinds of production and (or) the technologies connected with a high risk; an infrastructure of innovative activity? The organisations rendering subjects of innovative activity of service, necessary for realisation of innovative activity (63). In the Project makes a reservation that innovative activity is carried out according to the Constitution of the Russian Federation, the Civil code of the Russian Federation, the present Federal law and laws accepted according to it and other standard legal certificates of the Russian Federation, laws and other standard legal certificates of subjects of the Russian Federation, and also the international contracts of the Russian Federation, concerning innovative activity. If the international contracts of the Russian Federation establish other norms, than provided by the present Federal law norms of the international contracts (63) are applied. In the Project it is noticed that following kinds of activity concern innovative activity: Performance of the research, developmental and technological works directed on creation of new or advanced production, the new or advanced technological process, realised in an economic turn; carrying out of marketing researches and the organisation of commodity markets of innovative products; creation and development of an innovative infrastructure; preparation and retraining of personnel for innovative activity; protection, transfer and acquisition of the rights to objects of intellectual property both the confidential scientific and technological information; realisation of technological re-equipment and manufacture preparation; realisation of tests, certifications and standardization of new processes, products and products; the initial period of manufacture of new or advanced production, application of new or advanced technology before achievement of a standard time of recovery of outlay of the innovative project; Financing of innovative activity, including realisation of investments into innovative programs and projects; other kinds of works which necessary for realisation of innovative activity and are not contradicting the legislation of the Russian Federation (63). Subjects of innovative activity are legal bodies, irrespective of the organizational-legal form and a pattern of ownership, physical persons? Citizens of the Russian Federation, the foreign organisations and citizens, and also persons without citizenship. Subjects of innovative activity can carry out functions of customers and (or) executors of innovative projects and programs, investors, consumers of results of innovative activity, and also the organisations serving innovative process and promoting development and distribution of innovations (62). The state according to the current legislation guarantees to subjects of innovative activity: The state support of innovative programs and the projects directed on realisation of the state innovative policy; the state support of creation and development of subjects of an infrastructure of innovative activity; the state support to preparation, retraining and improvement of professional skill of the shots which are carrying out innovative activity; intellectual property protection, protection against an unfair competition and monopolism; access freedom to the information on priorities of the state innovative policy; freedom of distribution and gathering of the information on innovative requirements and results of scientific and technical and innovative activity, except for the information containing state, office and the trade secret (64). Public organisations and associations in which charter innovative activity is provided, can carry out on the competitive beginnings it at the expense of means of the federal budget, budgets of subjects of the Russian Federation and to get the state support. Public authorities of the Russian Federation, authorities of subjects of the Russian Federation by preparation of projects of standard legal certificates and programs in the field of innovative activity can involve public organisations and associations (62). The basic form of relations between subjects of innovative activity are the contracts (contracts) concluded according to the current legislation of the Russian Federation (63).

The disputes arising at realisation of innovative activity, are considered in an order established by the legislation of the Russian Federation and the legislation of subjects of the Russian Federation (62). Public authorities in an order established by the legislation of the Russian Federation and the legislation of subjects of the Russian Federation, can stop or suspend innovative activity in cases of spontaneous and other disasters, introductions of state of emergency in territory of the Russian Federation, and also if continuation of innovative activity can lead to infringement established by the legislation of the Russian Federation and the legislation of subjects of the Russian Federation of ecological, sanitary-and-epidemiologic and other norms and rules, the rights and interests legal and physical persons (62).

1.3 Working out and the analysis of the innovative project

By means of the innovative project the important problem on finding-out and a substantiation of technical possibility and economic feasibility of innovative activity dares. Despite a variety of projects, their analysis usually follows some general scheme which includes the special sections estimating commercial, technical, financial, economic and институциональную feasibility of the project. (49). Essentially the essence of the analysis of the innovative project consists in the answer to two simple questions (52:

1)) whether we Can sell a product which is growing out of realisation of the project?

2) whether we from it can receive sufficient volume of the profit justifying the investment project? The analysis of efficiency of the innovative project conditionally breaks on (52): the market analysis, the analysis of the competitive environment, working out of the marketing plan of a product, maintenance of reliability of the information used for the previous sections. As innovative projects are carried out at already existing markets, in the project their characteristic should be resulted. The marketing analysis should include the analysis of consumers and competitors also. The analysis of consumers should define consumer inquiries, potential segments of the market and character of process of purchase. For this purpose the developer of the project should carry out detailed research of the market. Besides, it is necessary to carry out the analysis of the basic competitors within the limits of market structure and restrictions, on it influencing (29). In drawing 1.1 the general sequence of the analysis of the innovative project is presented. It is necessary to notice, what the resolution used on the scheme? The project deviates? Has conditional character. The project should be really rejected in the initial kind. At the same time the project can be altered because of, for example, its technical impracticability and the analysis of the modified project should begin from the very beginning.

Let's describe high lights of the analysis of efficiency of the innovative project (37). The technical analysis (37) Problem of the technical analysis of the innovative project is:? Definition of the technologies most suitable from the point of view of the purposes of the project? The analysis of local conditions, including availability and cost of raw materials, energy, a labour? Stock-taking of potential possibilities of planning and project realisation. The technical analysis is usually made by group of own experts of the enterprise with possible attraction of narrow experts. Standard procedure of the technical analysis begins with the analysis of own existing technologies (51). The rule of a choice of technology provides the complex analysis of some alternative technologies and a choice of the best variant on the basis of any aggregated criterion (56). The financial analysis of (37) investment projects Given section is the most volume and labour-consuming. The general scheme of financial section of the innovative project follows simple sequence (37). 1) the Analysis of a financial condition of the enterprise in preparation of the innovative project. 2) the analysis of break-even of manufacture of principal views of production. 3) the forecast of profits and monetary streams in the course of realisation of the innovative project. 4) an estimation of efficiency of the innovative project. We will stop short on key questions of financial section of the innovative project. The financial analysis of the previous work of the enterprise and its current position usually is reduced to calculation and interpretation of the basic financial factors reflecting liquidity, credit status, profitableness of the enterprise and efficiency of its management. Usually it does not cause difficulty. It is important to present also in financial section the basic financial reporting of the enterprise for a number of previous years and to compare the basic indicators on years (51). The break-even analysis includes regular work under the analysis of structure of the cost price of manufacturing and sale of principal views of production and division of all costs into variables (which change with change of a volume of output and sales) and constants (which remain invariable at change of a volume of output). The Main objective of the analysis of break-even? To define a break-even point, i.e. a sales volume of the goods which corresponds to zero value of profit. Importance of the analysis of break-even consists in comparison of a real or planned gain in the course of realisation of the investment project with a point of break-even and the subsequent estimation of reliability of profitable activity of the enterprise (27). The Most responsible part of financial section of the innovative project is actually its investment part which includes (37):? Definition of investment requirements of the enterprise for the project? Establishment (and the subsequent search) sources of financing of investment requirements? Estimation of cost of the capital involved for realisation of the investment project? The forecast of profits and monetary streams at the expense of project realisation? An estimation of indicators of efficiency of the project. The most difficult is the question of an estimation of a recoupment of the project during its term of realisation (5). The volume of monetary streams which turn out as a result of project realisation should cover size of the total investment taking into account a principle? Costs of money in time?. Each new stream of money received in a year has the smaller importance, than equal to it on size the monetary stream received year earlier. As the characteristic measuring the time importance of monetary streams, the norm of profitableness from investment received acts during realisation of the investment project of monetary streams (5). The economic analysis (37) be integrated procedure of an estimation of economic efficiency can it is presented in the form of the following sequence (37: 1)) to Present results of the financial analysis. 2) to make new classification of expenses and incomes from the point of view of the economic analysis. 3) to translate financial values in economic (they do not coincide because of discrepancy of the prices and expenses for external and home market). 4) to Estimate cost of other possibilities for use of resources and reception of the same product. 5) to exclude all calculations on internal payments (as they do not change the general riches of the country). 6) to Compare annual economic streams of means with initial volume of the investment (it will be a final analysis). The institutsionalnyj analysis of (37) Institutsionalnyj the analysis estimates possibility of successful performance of the investment project taking into account organizational, legal, political and administrative conditions. This section of the investment project is not quantitative and not financial. Its main task? To estimate set of the internal and external factors accompanying the investment project (37). The estimation of internal factors is usually made under the following scheme. 1) the analysis of possibilities of industrial management. Well-known that bad management in a condition to fill up any, even over the good project. Analyzing industrial management of the enterprise, it is necessary to be focused on following questions (37):? Experience and qualification of managers of the enterprise? Their motivation within the limits of the project (for example, in the form of a share from profit)?

Compatibility of managers with the purposes of the project and the cores ethical and project cultural values. The analysis of a manpower. A manpower with which it is planned to involve for project realisation should correspond to level of technologies used in the project (42). The analysis of organizational structure. The organizational structure accepted at the enterprise should not brake project development. It is necessary to analyse, as there is at the enterprise a decision-making process and as distribution of responsibility for their performance is carried out. It is not excluded that it is necessary to allocate management of realisation of the developed investment project in separate administrative structure, having passed from hierarchical to matrix structure of management as a whole on the enterprise (51). The basic priorities in respect of the analysis of external factors are mainly caused by a policy of the state in whom following positions (37) are allocated for the detailed analysis:? Conditions of import and export of raw materials and the goods? Possibility for foreign investors to put means and to export the goods? Laws on work? Substantive provisions of financial and bank regulation. This points in question are most important for those projects which assume attraction of the western strategic investor (37). The analysis of risk (37). The essence of the analysis of risk consists in the following. Without dependence from quality of assumptions, the future always bears in itself an uncertainty element. The most part of the data necessary, for example, for the financial analysis (elements of expenses, the prices, production sales volume, etc.) Are uncertain. In the future forecast changes as to the worst (profit decrease), and in the best are possible. The risk analysis offers the account of all changes, both towards deterioration, and towards improvement (48). In the course of project realisation following elements are subject to change: cost of raw materials and accessories, cost of capital expenses, service cost, cost of sales, the prices and so on. As a result of target parametre, for example profit, will be casual. The risk uses concept of likelihood distribution and probability. For example, the risk is equal to probability to get negative profit, that is the loss. The wider range of change of factors of the project, the большему is subject to risk the project (57). As a rule, definitively innovative project is made out in the form of the business plan. In this business plan all questions listed above, as a rule, are reflected. The business plan of the innovative project, first of all, should meet requirements of that subject of innovative activity on which decision the further destiny of the project (36) depends. So, in chapter 1 of degree work theoretical bases of innovative activity in public health services have been considered, and, the basic terminology is entered, the economic reasons of innovations and legal maintenance of innovative activity are described. From chapter 1 it is possible to draw a conclusion, what a principal cause causing innovative activity in economy in general and in public health services in particular? The new market relations compelling each concrete enterprise to search additional sources of financing. These economic bases in turn generate the legislative base providing a legal field of innovative activity.

2. The technique of the estimation of efficiency of the innovative project

2.1 Existing technique of an estimation of the investment project

Existing (standard, classical) the technique of an estimation of efficiency of the innovative project includes (35:

1)) calculation of factor of the pure resulted cost (NPV);

2) calculation of an index of profitability of investments (PI);

3) calculation of internal rate of return or norm of profitability of the investment (IRR);

4) decision-making on project realisation. We will describe each step of this technique.

At the heart of process of acceptance of administrative decisions of investment character the estimation and comparison of volume of prospective investments and the future monetary receipts lie. As compared indicators concern the various moments of time, a key problem here is the problem of their comparability. To concern it it is possible differently depending on existing objective and subjective conditions: rate of inflation, the size of investments and generated receipts, horizon of forecasting, a skill level of analysts etc. The international practice of an estimation of efficiency of investments essentially is based on the concept of time cost of money and is based on following principles.

1) the estimation of efficiency of use of the invested capital is made by comparison of a monetary stream (cash flow) which is formed in the course of realisation of the investment project and the initial investment. The project admits effective if return of the initial sum of investments and demanded profitableness for the investors who have given the capital is provided.

2) the invested capital no less than a monetary stream is resulted by this time or by certain settlement year (which as a rule precedes the beginning of realisation of the project).

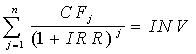

3) Process of discounting of capital investments and monetary streams is made under various rates of discount which are defined depending on features of investment projects. At definition of the rate of discount the structure of investments and cost of separate components of the capital are considered. The essence of all methods of an estimation is based on the following simple scheme: Initial investments at realisation of any project generate monetary stream CF1, CF2..., CFn. Investments admit effective if this stream is sufficient for? Return of the initial sum of capital investments and? Maintenance of demanded return on the invested capital. 1) calculation of factor of the pure resulted cost (NPV) (29) Calculation of this factor is based on comparison of size of the initial investment (IC) with a total sum of the discounted pure monetary receipts generated by it during predicted term. As inflow of money resources is distributed in time, it is discounted by means of factor r, established by the investor independently, proceeding from annual percent of return which he wants or can have on the capital invested by it. Let's admit, the forecast becomes that the investment (IC) will generate during n years, revenues at a rate of CF1, CF2, CF.... The general saved up size of the discounted incomes (PV) (Present Value) and the pure resulted cost (NPV) (Net Present Value) Pays off.

![]()

Where n? Quantity of the periods of time on which the investment, r is made? Norm of profitableness (profitableness) from an investment. It is obvious that if: NPV> 0 the project should be accepted; NPV <0 the project should be rejected; NPV = 0 the project not profitable and not the unprofitable Project with NPV = 0 has nevertheless additional argument to own advantage: though well-being of owners of the company in case of project realisation will not change, the volume of output will increase, i.e. the company will increase. At forecasting of incomes on years it is necessary to consider all kinds of receipts, both industrial character, and non-productive which can be with the given investment project.

It is necessary to notice that indicator NPV reflects a look-ahead estimation of change of economic potential of the enterprise in case of acceptance of the considered project. This indicator is additive in time, i.e. NPV various projects it is possible to summarise. This very important property allocating this criterion from others and allowing to use it as the core at the analysis of an optimality of the investment project. At comparison of two or several investment projects, obviously, it is necessary to choose that project which has higher value NPV (39). 2) Calculation of an index of profitability of investments (PI) (39) Pays off a profitability index (Profitability Index) (PI) under the formula:

PI = ∑k (Pk / (1 + r)k) / IC,

Where IC? Sizes of the initial investment; Pk? The prospective cumulative income; r? Norm of profitableness (profitableness) from an investment; k? Quantity of the periods of time (years). It is obvious that if: PI> 1 the project should be accepted; PI <1 the project should be rejected; PI = 1, the project neither profitable, nor unprofitable. Unlike the pure resulted cost the profitability index is a relative indicator, it characterises level of incomes on a unit of cost, i.e. efficiency of investments? The more value of this indicator, the above return of each rouble invested in the given project. Thanks to it criterion PI is very convenient at a choice of one project from a number alternative, having about identical values NPV, in particular, if two projects have identical values NPV, but different volumes of demanded investments, that, it is obvious that that from projects which provides the big efficiency of investments, or at acquisition of a portfolio of investments with the maximum total value NPV (26) is more favourable. 3) Calculation of internal rate of return or norm of profitability of the investment (IRR) (31) (Internal Rate of Return) (IRR) understand value of factor of discounting As internal rate of return or norm of profitability of the investment r at which NPV the project it is equal to zero: IRR = r, at which NPV = f (r) = 0.

Where CFj - an entrance monetary stream during j th period, INV? Value of the investment. The sense of this factor at the analysis of efficiency of planned investments consists in the following: IRR shows expected profitableness of the project, and, hence, as much as possible admissible relative level of expenses which can be ассоциированы with the given project. For example, if the project is financed completely at the expense of the loan of commercial bank value IRR shows the top border of admissible level of the bank interest rate which excess does the project unprofitable. Thus, IRR is as though? A barrier indicator?: if cost of the capital above value IRR? Capacities? It is not enough project to provide necessary return and return of money and therefore the project should be rejected (32). 4) (ARR) (12) This factor has Calculation of effectiveness ratio of the investment two characteristic features: he does not assume discounting of indicators of the income; The income is characterised by an indicator of net profit PN (balance profit minus deductions in the budget) (19). The algorithm of calculation is exclusively simple, as predetermines wide use of this indicator in practice: the investment effectiveness ratio (named also in registration rate of return) (Accounting Rate of Return) (ARR) pays off division of mid-annual profit PN into average size of the investment (the factor undertakes in percentage). The average size of the investment is division of the initial sum of capital investments into two if it is supposed that after term of realisation of the analyzed project all capital expenses will be written off; if presence of residual or liquidating cost (RV) its estimation should be considered in calculations is supposed.

ARR = PN / (1/2 (IC + RV)),

The given indicator is compared to factor of profitability of the advanced capital counted by division of the general net profit of the enterprise for a total sum of means, advanced in its activity (a result of average balance net) more often. The method based on use of effectiveness ratio of the investment, also has a number of the essential lacks caused, basically, that it does not consider time components of monetary streams. In particular it does not do distinction between projects with the identical sum of mid-annual profit, but the varying sum of profit on years, and also between the projects having identical mid-annual profit, but generated during various quantity of years. 5) decision-making by criterion of the least cost After a statement of the general scheme of standard model of an estimation of efficiency of investment projects, we will state some conclusions. There are investment projects in which it is difficult or it is impossible to calculate the monetary income. This sort of projects arise at the enterprise when it is going to modify the technological or transport equipment which takes part in many versatile work cycles and it is impossible to estimate a monetary stream. In this case as criterion for decision-making on expediency of investments operation cost acts.

2.2 Offered model of an estimation of efficiency of the innovative project

Feature of subjects of research considered in the present degree work consists what the general model of an estimation of efficiency of the innovative project in public health services till now is not made? This problem at thesis for a doctor's degree level on economy. In frameworks of usual degree research it is possible to offer only the model focused on the concrete innovative project. In this connection? To complete the picture? Before actually statement of offered model of an estimation of efficiency of the project it is necessary to describe in brief the project, i.e. to make the short resume of the project. The innovative project considered in the present degree research consists in the organisation of manufacture and sale of the diagnostic device? The biotest? предназначеного for a finding акупунктурных points, carrying out электропунктурной the express train of diagnostics of a condition of a human body by results of measurements of parametres of biologically active points, testings of preparations and therapy according to R.Follja's technique. The Scope - the diagnostic device of the doctor of the therapist, the homeopathist, the anaesthesiologist, etc. Novelty of the project (innovation, an innovation) consists what release of the product, analogue not having to in Russia, abroad is supposed? The device very cheap and reliable.

The device device. The case is made of shock-resistant polystyrene. On the obverse panel are located: 1 - the microampermeter 2 - the switch of operating modes of the device 3 - the switch? Diagnostics/therapy? 4 - the step switch of frequencies of therapy 5 - the indicator of inclusion and the category of the power supply 6 - light indicators of a finding of biologically active points (definition of degree of falling of an arrow) On a lateral surface of the device is located a regulator of amplitude of influence of electroimpulses. The device block diagramme? The biotest? It is presented on fig. 3 and includes: - the device of search of biologically active points - the measuring amplifier - the microampermeter - the setting generator with a frequency divider - target pressure

Remote terminal units: passive round electrodes; an active electrode; a foot electrode; a plate for testing of preparations and medicines Additional devices. Under the demand of the customer the device is completed with a charger (З.У.) . The charger is intended for gymnastics of accumulators (if they are present instead of electric batteries at a food compartment). As delivery of a diagnostic office of the doctor is possible. The device enters into it for device connection? The biotest? To the COMPUTER. The device of the coordination of the device has been for this purpose specially developed? The biotest? And the COMPUTER and as the software allowing completely is written to automate work of the doctor. Assortment. 1 kind of the device will be issued? The biotest? With стрелочным the indicator, completely corresponding to the above-stated description of Advantage of the given device in comparison with analogues available in the market. Device "Biotest" was developed strictly on the basis of R.Follja's method. The device has included all most necessary qualities such as simplicity, удобность both ease in circulation and device adjustment, small weight of a product, reliability and durability of a product, small power consumption, a food from battery power supplies "finger-type" which are widely accessible, aesthetic appearance of the device and its remote terminal units. Device life cycle? The biotest? Basically it will be defined by life cycle of the most applied method of R.Follja. Development tendencies will consist in device improvement, addition in it of new functions, improvement of available characteristics, change of appearance of the device. As it is planned to develop new updating of the device? The Biotest Th? With стрелочным the indicator + the additional digital indicator of level, degree of falling of an arrow and some other parametres. The offered model of an estimation of efficiency of the innovative project will include: 1) an estimation of competitive advantages of the goods (service), offered by the considered project; 2) an estimation of a market capacity of sale on which the considered project, including as the basic indicator the sales volume forecast is focused; 3) calculation of the capacity necessary for realisation of the project, and its comparison to a predicted sales volume; 4) calculation of the project of volume of investments necessary for realisation; 5) calculation? Break-even points?, i.e. critical for a recoupment of the project of volume of output; 6) summarising calculation of the basic indicators of the project, such as profit (total and pure); profitability of production; profitability of funds; the full cost price; labour input; the predicted price for production; a critical sales volume and release; efficiency of capital investments; a time of recovery of outlay; a stock of financial durability. A core of offered model is the analysis of break-even and a project recoupment. The break-even analysis includes regular work under the analysis of structure of the cost price of manufacturing and sale of principal views of production and division of all costs into variables (which change with change of a volume of output and sales) and constants (which remain invariable at change of a volume of output). The Main objective of the analysis of break-even - to define a break-even point, i.e. a sales volume of the goods which corresponds to zero value of profit. Importance of the analysis of break-even consists in comparison of a real or planned gain in the course of realisation of the investment project with a point of break-even and the subsequent estimation of reliability of profitable activity of the enterprise. The most responsible part of financial section of the project is actually its investment part which includes? Definition of investment requirements of the enterprise for the project? Establishment (and the subsequent search) sources of financing of investment requirements? Estimation of cost of the capital involved for realisation of the investment project? The forecast of profits and monetary streams at the expense of project realisation? An estimation of indicators of efficiency of the project. In the course of an estimation of a recoupment of the project the question of the account of inflation is critical. Really, the monetary streams developed in time, it is necessary to count in connection with change of purchasing capacity of money. At the same time there is a position according to which the final conclusion about efficiency of the investment project can be made, ignoring inflationary effect. In one of heads it will be shown that inflationary change of a price level does not influence an estimation of the pure value of monetary streams led to the present moment on which base the basic indicator of efficiency of the investment project is defined.

Two models applied to an estimation of efficiency of the innovative project were above described. A problem of this point? To give their comparative description. These models in two basic directions will be compared: by results and under the maintenance. Concerning comparison by results. Certainly, both these models bring the purpose the answer to an attention to the question, whether it is necessary to put up money in the considered innovative project or not; but these two models differently answer this question. In what here similarities and distinctions? It also is a problem of the comparative description of models by results. Comparison of models under the maintenance assumes transfer qualitative and the quantitative parametres used in both models, and also a conformity establishment between these two sets of parametres. Also it will be necessary to draw the general conclusion under the analysis of two models: what are? Pluses? And? Minuses? Applications of everyone them them what of them it is necessary to prefer at the analysis of the considered project, etc. Let's remind that the standard model assumes: 1) calculation of factor of the pure resulted cost (NPV); 2) calculation of an index of profitability of investments (PI); 3) calculation of internal rate of return or norm of profitability of the investment (IRR); 4) decision-making of realisation of the project. The offered model assumes 1) an estimation of competitive advantages of the goods (service), offered by the considered project; 2) an estimation of a market capacity of sale on which the considered project, including as the basic indicator the sales volume forecast is focused; 3) calculation of the capacity necessary for realisation of the project, and its comparison to a predicted sales volume; 4) calculation of the project of volume of investments necessary for realisation; 5) calculation? Break-even points?, i.e. critical for a recoupment of the project of volume of output; 6) summarising calculation of the basic indicators of the project, such as profit (total and pure); Profitability of production; profitability of funds; the full cost price; labour input; the predicted price for production; a critical sales volume and release; efficiency of capital investments; a time of recovery of outlay; a stock of financial durability; 7) decision-making on realisation (or to a deviation) the project. As it is possible to see, in sense of the purpose of application both these models have the purpose to answer a question, to accept to realisation or to reject the considered innovative project. On a way of the answer to this main point of model differ. Distinction consists what the standard model basically uses relative factors, and offered model? The absolute. To show this difference it is possible on a simple example: the standard model will tell that it is necessary to put money, as each enclosed rouble will bring 20 copecks of the income (i.e. Let's enclose 1 rouble, we will receive 1 rouble of 20 copecks), whereas the offered model of an estimation of efficiency will tell what to put up money in the innovative project costs, as the enclosed 1000 roubles will return as 1200 roubles. It is obvious, what this distinction not essential since at use of that and their other model it is possible to add with corresponding indicators? Standard model absolute, offered? The relative. The standard model uses relative indicators owing to tradition; the offered model uses absolute indicators from convenience reasons? At application of offered model it is possible to draw a conclusion of such grade that for realisation of the innovative project it is necessary to involve 14011 c.u. that through 7 months to receive 19873 c.u. Under the maintenance of indicators two considered models basically coincide. We will prove it. The standard model does not give possibility to execute an estimation of competitive advantages of the goods (service) offered by the considered project. However the standard model should contain this indicator as intermediate result? If the project is not directed on manufacture of a competitive product the project will be unprofitable and inefficient. A similar situation with a market capacity indicator? This indicator is not necessary for application of standard model, however, it does not mean that the offered model wins at standard, having this indicator. Capacity calculation is designated as an obligatory indicator at application of offered model. This indicator is not present as a part of standard model, however for calculations of factors of standard model anyhow it is necessary to know the capacity requested by the project. For this reason for application of standard model more low we will use this factor, but counted within the limits of application of offered model. Calculation of necessary volume of investments is necessary for application of both models: in offered model it is taken out as a separate indicator, in the standard? Is present at quality of parametre (intermediate result) at calculation of all indicators of standard model. Means, at application of standard model we will address partly to results of application of offered model. The break-even point pays off at application of offered model, but anything similar is not present in standard model. It is caused by what a break-even point? An indicator absolute whereas the standard model uses relative indicators. As to such characteristics of the project, such as profit (total and pure), profitability of production, profitability of the funds, the full cost price, the labour input, the predicted price for production, a critical sales volume and release, a time of recovery of outlay, a stock of financial durability? All of them are present at offered model, and at standard model there are only relative indicators, namely: efficiency of capital investments and analogue of an indicator of profitability of production. If the purposes of application of models coincide, some indicators and intermediate results are crossed, in what a difference between them and what for it is necessary to use two models? First of all, the numerical characteristics given by models, not should differ strongly from each other as we consider their application to the same project: If the standard model gives any numerical indicator its accuracy will be difficult for improving owing to that the standard model has already proved. We will draw conclusions by results of considerations of techniques of an estimation of efficiency of innovative projects. How it was possible to notice, the standard model is less labour-consuming in the application? In it, undoubtedly, there is an advantage of standard model before offered model. However, the basic difference between standard and offered models what the offered model gives more information on the concrete project? And in it the big advantage of offered model before the standard. For example, the standard model of an estimation of efficiency of the project cannot answer on a question, in what volume it is necessary to make production that the project was profitable? The standard model uses this indicator, but does not count it whereas the offered model at first counts it, and then uses. So, both those and other models can tell that, for example, as a result of three years of realisation the project will be profitable whereas the offered technique can tell that the project will pay off in 7 months. The offered model also has one essential lack? All basic indicators pay off on the basis of the sales volume forecast. But it is the forecast, obviously, can be only approximate. Hence, all basic indicators of offered model will be approximate. In the following chapter the comparative analysis of application of standard and offered model on an example of the concrete innovative project will be given.

3. The estimation of efficiency of the innovative project in public health services

3.1 Estimation of efficiency of the innovative project by a standard technique

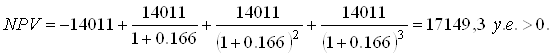

1) Calculation of factor of the pure resulted cost (NPV) For application of a standard technique of a case of the innovative project considered in the present degree work, all basic numerical data will undertake from point 3.2 of the present work. So the forecast, let us assume, becomes that the investment (IC) will generate within 3 years, revenues at a rate of CF1, CF2, CF.... The general saved up size of the discounted incomes (PV) (Present Value) and the pure resulted cost (NPV) (Net Present Value) Pays off.

![]()

Here n - quantity of the periods of time on which the investment is made, r - norm of profitableness (profitableness) from an investment. It is known that if: NPV> 0 the project should be accepted; NPV <0 the project should be rejected; NPV = 0, the project not profitable and not the unprofitable. For our project

Here and more low in work we will believe that 1 c.u. = 1$. We will notice also, what at the moment of 01.04.04 Central Bank rate of the Russian Federation of the American dollar made 28 rbl. 13 copeck Here in the first composed number 14011 of c.u. with a minus corresponds to the full cost price of the project, r=0,166, or, what the same, r=16,6 %? Level of profitability (profitableness) of the project. For our project the settlement size is more than zero, the project profitable means. 2) calculation of an index of profitability of investments (PI) Pays off a profitability index (Profitability Index) (PI) under the formula:

PI = ∑k (Pk / (1 + r)k) / IC,

Let's remind that if: PI> 1 the project should be accepted; PI <1 the project should be rejected; PI = 1, the project neither profitable, nor unprofitable. For our project it is had:

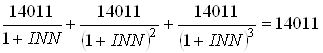

Here 8721 c.u.? Net profit size. In brackets three composed as we investigate the project within three years? 2005, 2006 and 2007 whereas we begin project realisation in 2004. For the considered project this size is more than unit, hence, the project profitable. 3) calculation of internal rate of return or norm of profitability of the investment (IRR) (Internal Rate of Return) (IRR) understand value of factor of discounting As internal rate of return or norm of profitability of the investment r at which NPV the project it is equal to zero: IRR = r, at which NPV = f (r) = 0.

.

.

Where CFj - an entrance monetary stream during j th period, INV - value of the investment. Strictly speaking, this factor dismisses not so much, how many the equation, having solved which, we will find the norm of profitableness INN is minimum necessary for realisation of the project. For our project it is had a following equation:. We will notice that in the left member of equation three composed owing to that consideration is conducted for three years. A trial and error method we find that for performance of following equality it is necessary, that approximate equality was observed. It means that the norm of profitableness of 8,1 % whereas from following point it will be visible that norm of profitableness of our project of 16,6 % is necessary for a project recoupment. It means that it is necessary to recognise the project profitable. We will draw conclusions by results of calculations of the basic factors of model under the decision on acceptance or a project deviation is accepted after consideration of values resulted above factors. As we saw, all these factors have yielded that result that the project profitable and it should be accepted to realisation.

3.2 Estimation of efficiency of the innovative project by an offered technique

Industrial competitive advantages. For device manufacturing? The biotest? Components will be used inexpensive, not scarce, широкодоступные, but at the same time qualitative, basically import manufacture. In this connection the device will have high consumer properties at the low cost price. A market estimation. The market of the medical equipment in Russia is not sated enough by the equipment of the given direction (23) whereas the developed device has no strong contenders both on Russian, and in the foreign market. It promotes fast advancement of the device on the market of Russia and the near abroad. Changes in the given market can occur under the influence of following external factors: - occurring in the currency market - preference of consumers As it is necessary to pay attention of change to the internal factors influencing a condition of the given market: - a competition; - change of internal structure of participants of the market. All it leads to constant changes in the given market that and as consequence constant improvement and expansion of assortment of production, and as to expansion of a variety of the services given together with the offered goods constantly promotes qualitative improvement of structure of participants. Novosibirsk scientists carry out statistical researches, applicable for the marketing analysis of the market of medical services (24). On the spent statistical researches the schedule of distribution by consumers of given production on categories has been constructed:

15 % - the Doctors who are engaged in individual activity of 30 % - the Medical institutions applying non-standard methods of diagnostics and treatment of 55 % - the Medical institutions rendering additional paid services of a Fig. 3.1.? Distribution of consumers on categories From the resulted data we see, what more than half (55 %) consumers of medical services address in the establishments rendering additional paid services? But these establishments just also are potential buyers of production for which the investment project (61) is developed. That fact is interesting that in the Russian market at present there are all some competitors (25): * Peterlink Electronics. It is the German company, she offers very high-class devices working only complete with the COMPUTER and the software. Production of this company has no such necessary property as compactness and mobility. The firm offers completely equipped offices intended only for work with this device. Completely equipped office costs approximately $20000. Such expenses are presumed only by the provided medical institution. * Kindling. It too the company from Germany. About it there is an information small amount. Devices of this company are delivered and work both from the COMPUTER and without the COMPUTER but as have no property of compactness and mobility. The complete set of the equipment of the given company costs approximately from $5000 to $6000 depending on a complete set. * Start-1. It is the Russian firm. Makes complexes both from the COMPUTER, and without the COMPUTER. It is known that the complex without the COMPUTER costs approximately $1400. The basic advantage of all three listed companies consists that in their devices there is a quantity of additional functions, but this advantage is not the main thing. Lacks of all three companies consist that: - Devices do not have properties of compactness, mobility, and they are difficult in circulation; - the high prices for complexes. Advantages of our device are its such properties as: mobility, compactness, possibility to work both in stationary, and in field conditions, possibility to work both complete with the COMPUTER, and without the COMPUTER, very low price at quality not conceding to competitors, but in our device are collected only the basic functions which are the most necessary. A lack of the given device is absence in it of additional functions available for competitors. A company lack is its not so wide popularity on the given segment of the market, but this lack constantly decreases. The table in which the advantages set forth above and lacks are shown is more low resulted.

Let's notice that at the moment of April, 1st, 2004 1 American dollar on a Central Bank rate of the Russian Federation made 28 rbl. 15 copeck Of the table it is visible that the considered device has big advantages in comparison with the competitive. The goods of competitors are calculated basically on a narrow circle of the consumers having their possibility to buy, and many have such possibility far not. At the same time the considered device has low enough price at the basic requirements not conceding to competitors, and in some parametres them even surpasses. Demand forecasting. For the forecast we will take advantage of mathematical modelling of demand for the developed device? The biotest?. The essence of an applied mathematical method consists in extrapolation of the statistical data about presence of similar devices in medical institutions of a city and area for 2002-2004 on volume of demand for the considered device in 2005. For extrapolation carrying out it is necessary to calculate a trend line. Calculation of a straight line of demand. The general equation of a straight line (8)

y=a